Built for filing on the go.

Smart features that help you stay organized and keep moving.

Stay on top of your tax filing.

See exactly where you stand with easy-to-read progress dashboards. Track what’s done, what’s left, and how close you are to being finished. No surprises, just clarity.

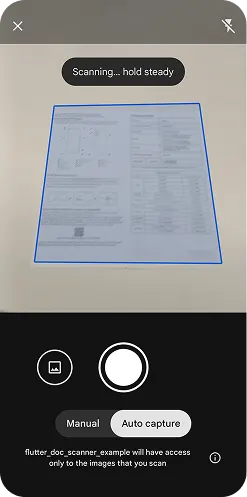

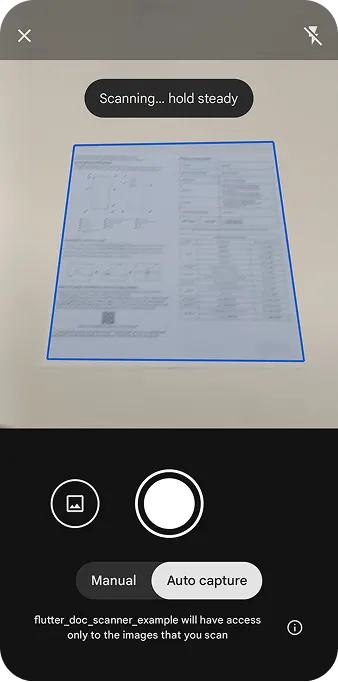

Easy doc import.

Skip the manual entry. Take a photo, pick an image from your gallery, or upload a file from your phone. We’ll securely import the details, so you don’t have to.

We guide you to your max refund — step-by-step.

Our guided experience walks you through each part of your return with simple explanations and smart prompts, so you can file with confidence.

Stay on top of your tax filing.

See exactly where you stand with easy-to-read progress dashboards. Track what’s done, what’s left, and how close you are to being finished. No surprises, just clarity.

Easy doc import.

Skip the manual entry. Take a photo, pick an image from your gallery, or upload a file from your phone. We’ll securely import the details, so you don’t have to.

We guide you to your max refund — step-by-step.

Our guided experience walks you through each part of your return with simple explanations and smart prompts, so you can file with confidence.

Your info stays secure — even on mobile.

Everything you upload in the app is encrypted and securely stored on our systems, so your uploaded tax documents and sensitive information stay protected, even if your device is lost or accessed by someone else.

Solutions for all kinds of filers.

Everyone’s tax situation is unique, so we give you options that fit your needs.

Free

Free Federal

~44% of TaxAct filers qualified last year based on income & deductions. See if you qualify.

Deluxe

Home & Family

For taxes that get more complex – like childcare and property.

Everything in Free plus:

Premier

Investments

Good for those who earned income from investment assets.

Everything in Deluxe plus:

Self-Employed

Entrepreneur

For business owners, freelancers, side hustlers, and gig workers.

Everything in Premier plus:

Or file your business taxes on-the-go.

Convenience built in — for filing that never slows you down.

Best DIY tax program for contractors

“I cannot remember the first year I used TaxAct however, when they prompt me that the time to file is upon me I click the link and breeze through.”

@Amos Feb 25, 2025

Great

“First time filing as 1099 contract employee with a home office. Was very helpful.”

@Go la r bled May 6, 2025

Love TaxAct

“Easy to use. This was my time being a contractor and the easy to answer questions made it a breeze to complete my taxes.”

@RAP56 Feb 13, 2025

Frequently Asked Questions

You can prepare and file your taxes in the app with the same guided, step-by-step experience you’d expect on desktop; up to and including filing your federal and state returns.

$14.99 offer applies to new customers who use the TaxAct mobile app to start an online consumer prepared tax year 2025 federal and state 1040 return and file by 11:59 PM CT on 02/28/2026. Includes federal plus 1 state return. Fees apply for additional state returns and ancillary products and services. Discount may not be combined with other offers or bundles. Add sales tax for applicable orders.