Online

Be your own boss, not your own tax pro. Self-Employed can help.

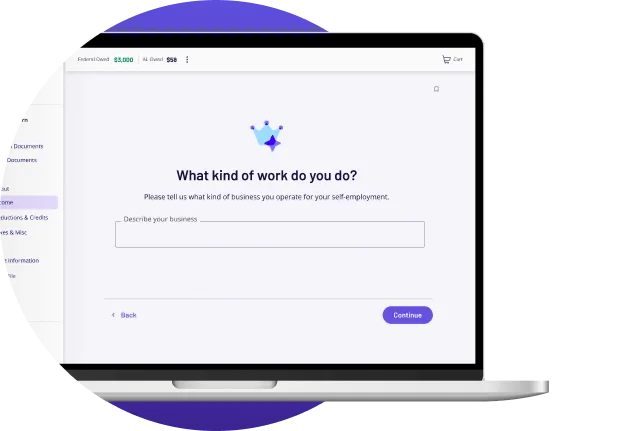

Whether you’re freelancing or fully self-employed, TaxAct Self Employed finds write-offs and walks you through your return step-by-step.

Everything in Premier plus:

Contract, freelance, rideshare

Owner / sole proprietor

Made for how you earn.

Freelance gigs, client invoices, or tips -- Self Employed can keep up with the way you work and however you earn.

Go ahead, write it off.

TaxAct’s smart tools help you spot deductions for things like supplies, mileage, and marketing.

We’ve got your back.

Tap into expert-backed support, so you can file with confidence every step of the way.

Start now — Pay only when you file.

Get started for free: import your W-2 and see how easy filing can be.

Gain confidence for less effort, time, and money.

With Unlimited Access, you can talk one-on-one with a credentialed tax expert to ask any questions you might have before you file.

Unlimited Access

Contact us at any step during your return and as often as you like for guidance. Your questions will be answered quickly and accurately.

Select list of Federal tax forms supported.

Looking for what’s included at the state level? We’ve got you covered — check out the forms available for your state.

4.4 Stars | 31,102+ Reviews

Real People. Real Reviews.

You don't have to take our word for it. See All Reviews

By far the best

“I have been doing my own taxes for many years. I also do taxes for my family members and friends. I have tried out several online software programs for taxes but taxact is by far the best. Its very easy to use and thorough.”

@denise 1977 - Greenville, NC

Seamless process

“I have filed with TaxAct for the past 10 years and the process continues to be seamless. Each step makes it easy to understand and gives you the confidence to finish your filing.”

@Kenjcc948 - Richmond, VA

Been Using For Years

"Very glad to be using the software and that it keeps up with ever changing tax rules. I have been using it for years and will continue to.

@NonaP - South Carolina

All reviews are from verified TaxAct customers.

4.4 Stars | 31,102+ Reviews

Real People. Real Reviews.

You don't have to take our word for it. See All Reviews

They have me for life!

“...The online service was very user friendly, caught my mistakes, and made user I got everything I was owed. Every time I go back, half the work is already done because they retain the most important information...I have total peace of mind...” (edited for length)

@ChefLynnejai Feb 7, 2025

Easy to use, step by step instructions

“I’ve been using TaxAct for many years. A great deal of information transfers from year to year. Easy step by step format and offers state filing also. Last year I needed help with one issue and was able to speak to an expert to help me out. ”

@Bob1493 April 21, 2025

First time usage

"I was very pleased with TaxAct. I was able to maneuver and it gave me explanations along the way. It is definitely worth the low cost of filing the self employment forms."

@Budget Friendly May 3, 2025

All reviews are from verified TaxAct customers.