Privacy & Security Frequently Asked Questions (FAQs)

What are suspicious emails or phishing?

Phishing, as it is called, is the act of sending an email to a user falsely claiming to be an established legitimate enterprise in an attempt to scam the user into surrendering private information that will be used for identity theft.

Report Phishing, email scams and bogus IRS Web sites.

According to the Federal Trade Commission, the nation's consumer protection agency, phishers send an email or pop-up message that claims to be from a business or organization that you may deal with - for example, an Internet service provider, bank, online payment service, or even a government agency. The message may ask you to 'update', 'validate', or 'confirm' your account information.

Some phishing emails threaten a dire consequence if you don't respond. The messages direct you to a website that looks just like a legitimate organization's site - but it isn't. It's a bogus site whose sole purpose is to trick you into divulging your personal information so the operators can steal your identity and run up bills or commit crimes in your name.

The IRS can use the information, URLs and links in the suspicious emails you forward to trace the hosting website and alert authorities to help shut down the fraudulent sites.

Why am I not receiving emails from TaxAct?

If you haven't been receiving the emails you're expecting from TaxAct, please confirm that your ISP is not temporarily blocking or filtering our emails. You should also be sure to add us to your address book or trusted sender list.

Addresses to add to your trusted sender list: salesreply@taxact.com, reply@taxact.com and reply@e.taxact.com

Why am I am receiving emails intended for someone else?

It appears someone may have mistyped their email address when registering their account or entering the email address to receive notifications about their electronically filed TaxAct income tax return.

Our system checks an email address to make sure it is in the correct format. We have no way to verify if an email address entered by a customer is indeed their own. This makes addressing this issue somewhat problematic as we have no other way to contact the customer who has entered the email address incorrectly.

Please contact us and let us know of this issue. We will remove your email address from their account to prevent future emails from sending to your address and note the account to alert the account holder to correct their email address.

What do I do if I have been a victim of fraud?

If you are a victim of fraud, here are the actions you can take to protect yourself against identity theft.

Place a fraud alert on your credit file.

A fraud alert notifies creditors that you may be the victim of fraud and tells them to contact you before opening any new accounts. Please call any one of the three nationwide consumer reporting agencies listed below. By calling one reporting agency, the other two will automatically be notified. They will place a fraud alert on your credit file and will assist you in getting a free credit report from each of the three agencies. The initial fraud alert will last for 90 days. You may want to renew it after the first 90 days. If you have already filed a police report about the theft, you should place an extended fraud alert on your credit file. It will be valid for 7 years. The fraud alert is a free service.

Equifax: 1-800-525-6285

Experian: 1-888-397-3742

TransUnion: 1-800-680-7289

Review your credit reports carefully.

Please look for accounts you did not open or inquiries from creditors that you did not initiate. Look for personal information, such as an address, that is not accurate. If you see anything you do not understand, call the consumer reporting agency at the telephone number listed on the report.

Be vigilant regarding your personal financial data for the next 12-24 months

Carefully review your credit reports and account statements. If you discover suspicious activity on your credit report or by any other means, please call your local police right away and file a police report of identity theft.

Learn more about identity theft.

The Federal Trade Commission has on-line guidance about the steps that consumers can take to protect themselves against identity theft. You can call 1-877-ID-THEFT (1-877-438-4338) or visit the Federal Trade Commission's website at www.consumer.gov/idtheft to get more information. We also encourage you to report suspected identity theft to the Federal Trade Commission.

Why am I getting a security warning when downloading my TaxAct software?

When installing programs on your computer, you may receive a security warning indicating that a publisher could not be verified or that the program is unknown.

Whenever you receive this type of message, you should verify that the program is coming from a trusted source.

If you are installing TaxAct and have signed into our download servers using your Customer ID and password, you can rest assured that the program you are installing has come from TaxAct. You can trust TaxAct to be virus free.

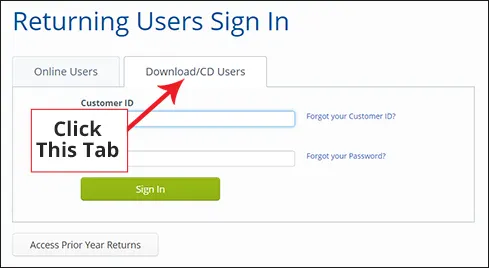

To ensure that you are signing into the correct servers, you can sign in here. Please ensure that you are signing into the correct servers by selecting the Download/CD Users tab as indicated below:

Why do I keep getting a "prohibited access" or "page not available" error when accessing TaxAct?

This problem occurs because installing Service Pack 2 for Windows XP Professional enables the Windows Firewall. By default, the Windows Firewall blocks most incoming traffic, including the HTTP protocol and the HTTPS protocol. The HTTP protocol and the HTTPS protocol are used to access a Web site.

Please follow the link below to configure your Windows Firewall settings:

http://support.microsoft.com/default.aspx?scid=kb;en-us;884488

If you continue to experience the same error messages after configuring the Windows Firewall, check your computer to see what other firewall software may be running. If you think that your ISP might have a firewall, we would recommend contacting your ISP to find out how to temporarily disable the firewall so you can access our site. If you are using a third party firewall product, such as Zone Alarm or Black Ice, please contact the software/hardware company for support.

How do I enable pop-ups when using TaxAct?

TaxAct Online uses pop-up windows in various places throughout the program as you prepare and file your tax return. If you are using software that disables pop-up browser windows (such as the Google toolbar or Internet Explorer 6), you may need to disable this feature for 'www.taxact.com' in order to complete your tax return.

For detailed instructions on how to disable your pop-up blocker, visit Help Topic: How to Disable your Pop-up Blocker

How do I opt out of marketing emails?

You can opt out of receiving emails from TaxAct by submitting your email address on the TaxAct Email Unsubscribe Request page. If you need to update your communication preferences or email address, please do so by signing in to your account. View instructions here.