Online

Investments? Rental income? Premier got you covered.

Built for people with investments, property income, or other not-so-basic tax situations. You handle the portfolio, we'll handle your tax filing.

Everything in Deluxe plus:

Selling stocks or crypto

Selling a home

Rental income

Foreign Bank Account Report (FBAR) Filing

For your investments and income beyond the 9 to 5.

Whether it's stocks, crypto, or property income, Premier makes it easy to get it right.

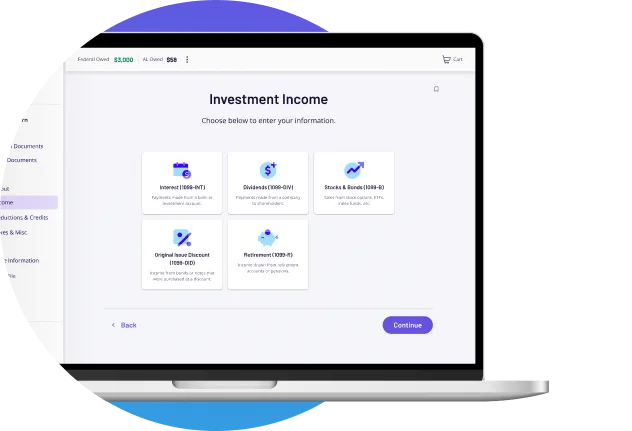

Built for complexity, made simple.

We walk you through every step so you can file with confidence, even when your taxes are a little tricky

All the details. None of the stress.

We'll help you report everything accurately, spot money-saving deductions, and move on with your life.

Start now — Pay only when you file.

Get started for free: import your W-2 and see how easy filing can be.

Gain confidence for less effort, time, and money.

With Unlimited Access, you can talk one-on-one with a credentialed tax expert to ask any questions you might have before you file.

Unlimited Access

Contact us at any step during your return and as often as you like for guidance. Your questions will be answered quickly and accurately.

Select list of Federal tax forms supported.

Looking for what’s included at the state level? We’ve got you covered — check out the forms available for your state.

4.4 Stars | 31,904+ Reviews

Real People. Real Reviews.

You don't have to take our word for it. See All Reviews

By far the best

“I have been doing my own taxes for many years. I also do taxes for my family members and friends. I have tried out several online software programs for taxes but taxact is by far the best. Its very easy to use and thorough.”

@denise 1977 - Greenville, NC

Seamless process

“I have filed with TaxAct for the past 10 years and the process continues to be seamless. Each step makes it easy to understand and gives you the confidence to finish your filing.”

@Kenjcc948 - Richmond, VA

Been Using For Years

"Very glad to be using the software and that it keeps up with ever changing tax rules. I have been using it for years and will continue to.

@NonaP - South Carolina

All reviews are from verified TaxAct customers.

4.4 Stars | 31,904+ Reviews

Real People. Real Reviews.

You don't have to take our word for it. See All Reviews

TaxAct takes you through your return step by step.

“...Had numerous long term stock options and it was easy to input...I have been using this software for ten years now and it's the most concise and accurate product on the market. I always get a max refund.” (edited for length)

@Jimmyzinga Feb 26, 2026

Fast and easy!!!!!

“I have used TaxAct for many years and have had no problems. The questions that are asked cover any possibility of what I have to claim and my filing and receipt of refunds are FAST.”

@TaxAct fan! Feb 26, 2026

TaxAct 2025

“I’ve been using this for over 20 years. Very simple to use.”

@SteveMK Feb 26, 2026

All reviews are from verified TaxAct customers.