Desktop

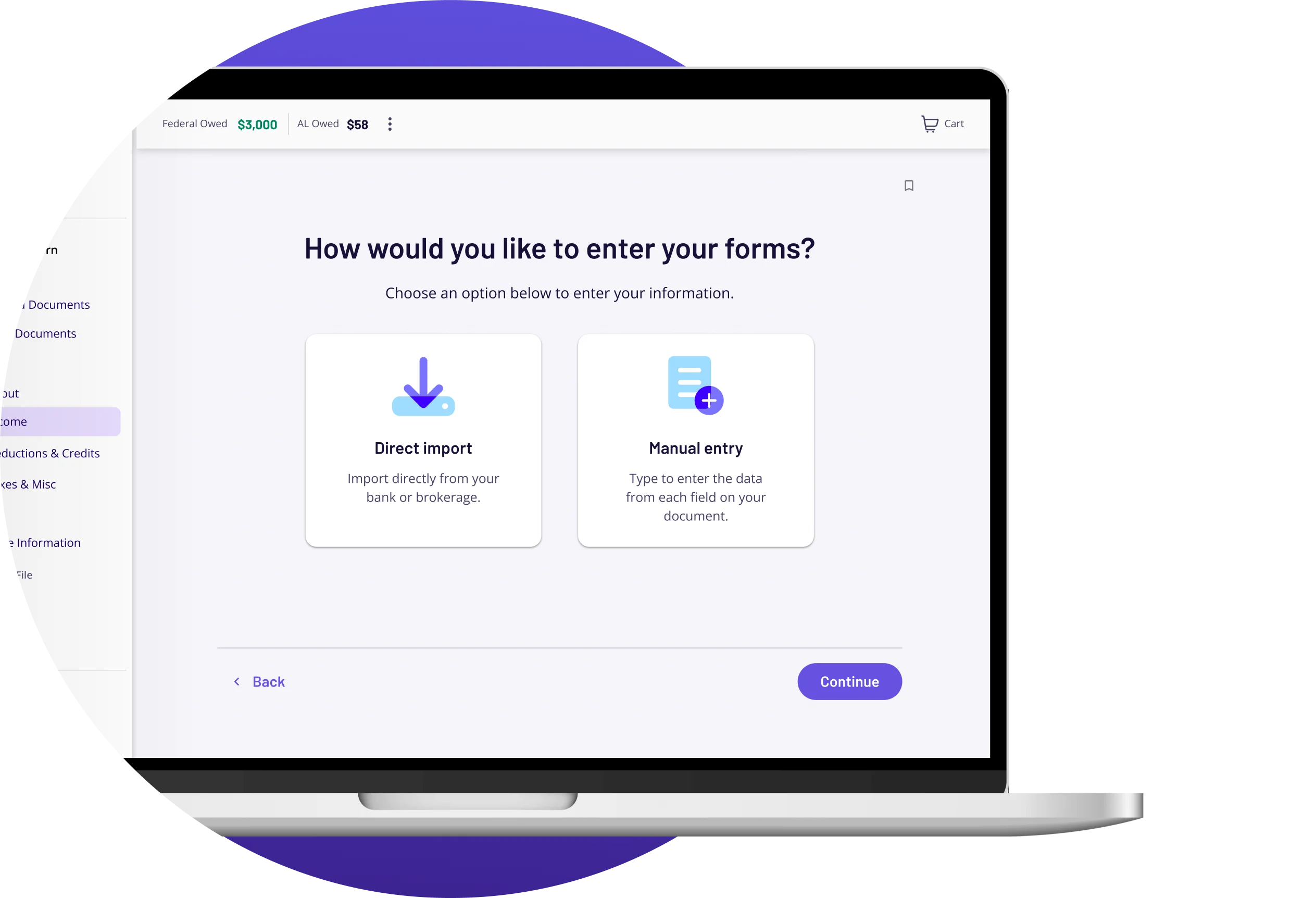

Simple. Accurate. Basic Tax Filing On Your PC.

Get peace of mind with TaxAct® Basic, the downloadable tax filing software designed to make federal filing on your PC simple and affordable.

W-2 & Unemployment

Current Students

Child Tax Credit and more

Desktop System Requirements

Recommended Requirements

Operating system: Windows 10 or 11

Processor: Intel Core i5 or equivalent AMD

Memory: 8 GB RAM

Disk Space: 2 GB per tax year

Display: 1920 x 1080 resolution or higher

Internet: High-speed connection (DSL or Cable/Broadband)

Minimum Requirements

Operating system: Windows 10

Processor: Intel Core i3 or equivalent AMD

Memory: 8 GB RAM

Disk Space: 600 MB per tax year

Display: 1920 x 1080 resolution or higher

Internet: High-speed connection (DSL or Cable/Broadband)

Recommended Requirements

Operating system: Windows 10 or 11

Processor: Intel Core i5 or equivalent AMD

Memory: 8 GB RAM

Disk Space: 2 GB per tax year

Display: 1920 x 1080 resolution or higher

Internet: High-speed connection (DSL or Cable/Broadband)

Minimum Requirements

Operating system: Windows 10

Processor: Intel Core i3 or equivalent AMD

Memory: 8 GB RAM

Disk Space: 600 MB per tax year

Display: 1920 x 1080 resolution or higher

Internet: High-speed connection (DSL or Cable/Broadband)

Built-in confidence, backed by $100K.

We guarantee our tax refund calculations are accurate -- or we'll make it right.*

Get every dollar you deserve.

We're made to help you get your maximum tax refund -- and we guarantee it.*

Customer care, made for you.

From login issues to tech hiccups, we're here to get you back on track.

Select list of Federal tax forms supported.

Starting at $44.99

Includes 1 State

Starting at $139.99

Includes 1 State

Starting at $149.99

Includes 1 State

Starting at $164.99

Includes 1 State

Looking for what’s included at the state level? We’ve got you covered — check out the forms available for your state.

4.4 Stars | 31,102+ Reviews

Real People. Real Reviews.

You don't have to take our word for it. See All Reviews

By far the best

“I have been doing my own taxes for many years. I also do taxes for my family members and friends. I have tried out several online software programs for taxes but taxact is by far the best. Its very easy to use and thorough.”

@denise 1977 - Greenville, NC

Seamless process

“I have filed with TaxAct for the past 10 years and the process continues to be seamless. Each step makes it easy to understand and gives you the confidence to finish your filing.”

@Kenjcc948 - Richmond, VA

Been Using For Years

"Very glad to be using the software and that it keeps up with ever changing tax rules. I have been using it for years and will continue to.

@NonaP - South Carolina

All reviews are from verified TaxAct customers.

4.4 Stars | 22,500+ Reviews

Real People. Real Reviews.

You don't have to take our word for it. See All Reviews

My go-to tax software

“I’ve been using TaxAct for years and have always been completely satisfied.”

@frank22 Feb 7, 2025

Easy to do and file!

“I have been using TaxAct for many years now to do my federal and state taxes. It’s very simple and user friendly. All you have to do is follow the prompts and answer questions. And the software does the rest. I received my federal tax refund in under 10 days this year.”

@Catty63 Mar 13, 2025

Ease of use

"This site makes doing taxes simple; just answer the questions and your taxes are done!"

@knittingasapastime Mar 13, 2025

All reviews are from verified TaxAct customers.