Schedule K-1 (Form 1120-S)

Schedule K-1 (Form 1120-S)

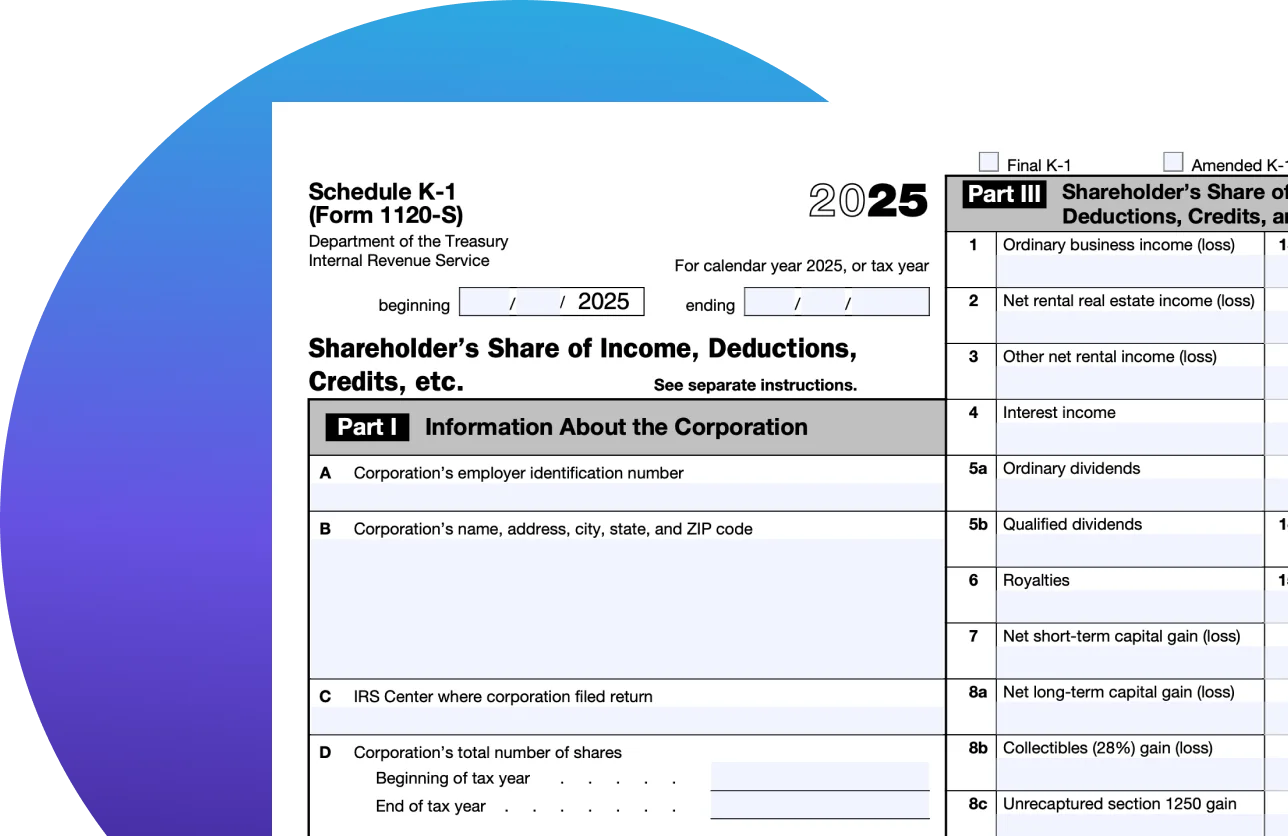

Shareholder’s Share of Current Year Income, Deductions, Credits, and Other Items

Start Filing

What Is Schedule K-1 (Form 1120-S)?

Form 1120-S, U.S. Income Tax Return for an S Corporation, is an informational document that lets the Internal Revenue Service (IRS) know how much income your business made and how much tax you owe.

Related Information

What Is a Schedule K-1?: A Guide and Instructions on How to File

Learn everything you need to know about what a Schedule K-1 is, why it’s important, and how to easily e-file it with TaxAct®.

Schedule K-1 (Form 1120-S) - Entering in Program

Steps on how to enter or review information from Schedule K-1 (Form 1120-S). TaxAct will guide you through each section, making it easy to accurately report your K-1 details in the right place on your return.

How to Fill Out Form 1120-S for S Corporations

Guide to completing IRS Form 1120-S for S corporations. Learn about deductions, income reporting, and tips for accurate filing.

Key Tax Deadlines For Small Business Owners

Curious about the business tax deadlines that you should mark on your calendar? Given are the details of the deadlines for filing small business tax returns.

A Guide for S Corporations

Find all that you need to know about Form 1120-S — what it is, what are schedules, how and when to file & more.

A solution for every tax situation

Not sure where to start? Take our 2-question quiz and find the right tax prep option for you in 30 seconds.