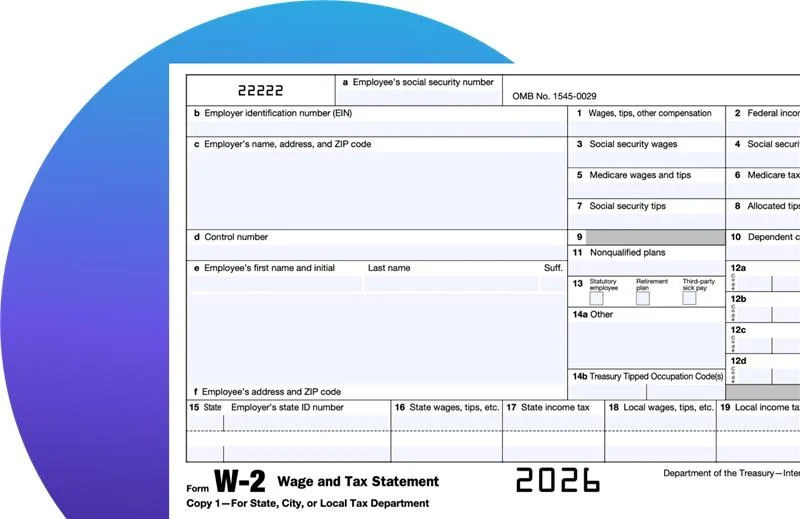

What Is Form W-2?

IRS Form W-2, also called your Wage and Tax Statement, is sent by your employer and filed with the IRS each year. It reports your annual wages and the taxes withheld from your paycheck.

Form W-2 Instructions

Starting with the boxes on the left:

Box a: Reports your Social Security number (SSN). Ensure this is correct — an incorrect SSN can delay the processing of your tax return.

Box b: Your employer’s Employer Identification Number (EIN) is reported in box b. An EIN is a nine-digit number assigned to your employer by the IRS and used to identify the tax accounts of employers.

Box c: Reports the legal address of your employer. This may or may not be the actual address of where you work, depending on if your employer has multiple offices with a corporate site.

Box d: Reports the control number used by your employer’s payroll department. This may or may not be blank.

Box e and f: Your legal name, as it reads on your Social Security card, appears in box e, and your mailing address is reported in box f. If that information is incorrect, it could delay the processing of your return.

Here’s a closer look at the boxes on the right:

Box 1: Shows your total taxable wages, tips, prizes, and other compensation for the year, minus certain elective deferrals, such as 401(k) plans and pretax benefits. The number from box 1, is reported on line 7 of your Form 1040.

Box 2: Shows the total federal income tax withheld from your pay for the year, based on your Form W-4. To adjust your withholding, update your W-4 with your employer. This amount is reported on your Form 1040.

Box 3: Shows your total wages that are taxed for Social Security.

Box 4: Shows the total Social Security taxes withheld from your pay for the year. Unlike federal income taxes, Social Security taxes are calculated based on a flat rate of 6.2% for employees.

Box 5: Indicates all your wages and tips that are taxed for Medicare.

Box 6:The total amount of Medicare tax withheld from your pay for the year. Much like Social Security taxes, Medicare taxes are also figured on a flat rate, which is 1.45% for employees.

Box 7:Shows any tips that you reported.

Box 8:Shows any allocated tips that your employer has figured attributable to you. These are considered as income.

Box 9:Should be blank, as this requirement has expired.

Box 10: Reports the total amount deducted from your wages for dependent care assistance programs. It may also include contributions made by your employer for dependent care on your behalf.

Box 11:Reports the total amount distributed to you from your employer’s non-qualified deferred compensation plan.

Box 12:Reports several different types of compensation and benefits. If applicable, this box will indicate a single or double letter code followed by a dollar amount.

Box 13:Your employer checks any boxes that apply to you: Statutory employee (subject to Social Security and Medicare but not federal income tax withholding), retirement plan participant, or third-party sick pay recipient.

Box 14:Reports anything that doesn’t have a specific box anywhere else on Form W-2.

Box 15:Includes your employer’s state and state tax identification number.

Box 16: Indicates the total amount of taxable wages for state tax purposes (if you are subject to state income taxes).

Box 17: Shows the total amount of state taxes withheld from your wages for the year.

Box 18:If you are subject to local, city, or other state income taxes, box 18 reports those wages.

Box 19:Reports the total amount withheld from your wages for local, city, or other state income taxes.

Box 20:Is the legal name of the local, city, or other state tax being reported in box 19.

A solution for every tax situation

Not sure where to start? Take our 2-question quiz and find the right tax prep option for you in 30 seconds.