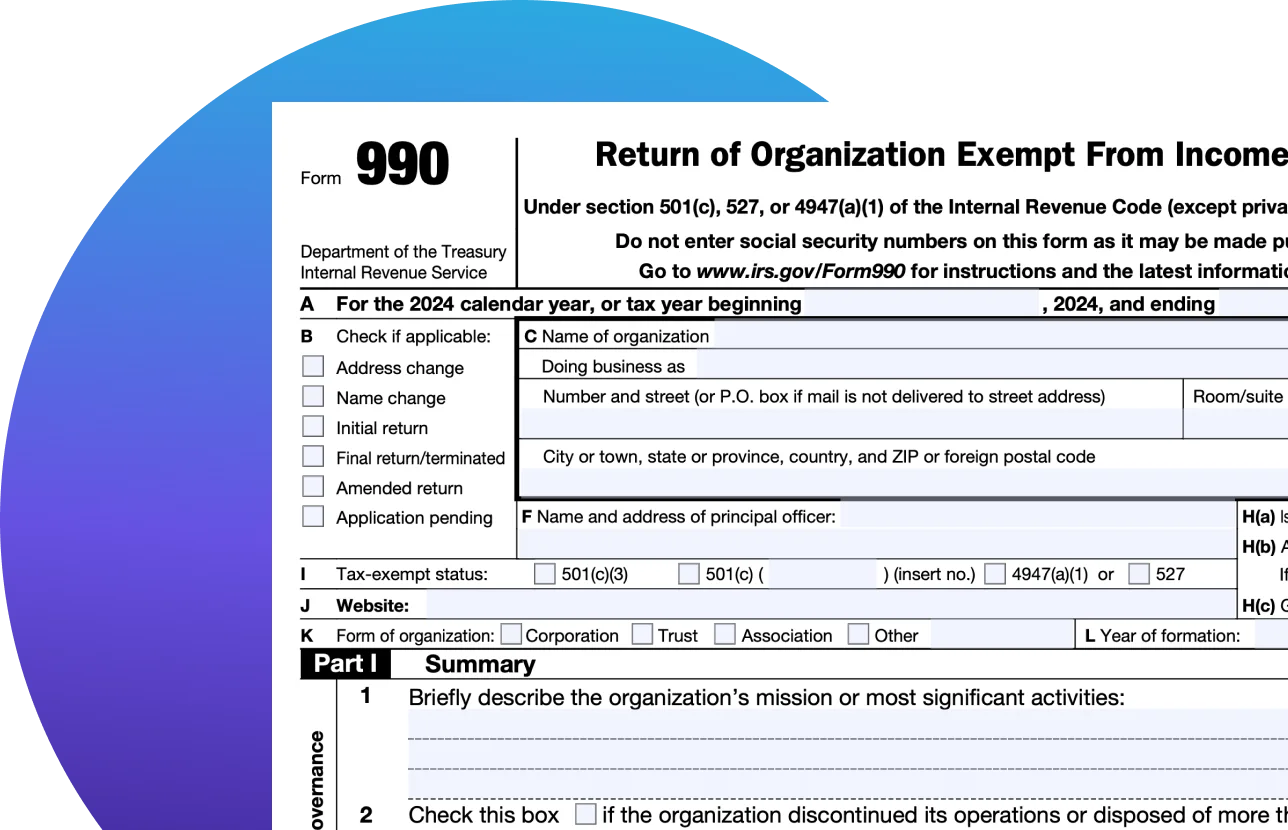

What Is Form 990?

IRS Form 990 is an information return that tax-exempt organizations, also called 501(c)(3) organizations or charitable organizations, use to report their financial information to the IRS.

Related Information

Filing Form 990: A Guide for Nonprofit Organizations

Learn about IRS Form 990 and its schedules with examples, definitions, and FAQs. Find out how nonprofits report financials, fulfill transparency, and stay compliant.

What Tax Forms Do I Use to File My Business Return?

While filing a federal tax return for your business, the tax forms you will use depend on your business type and how well it is organized.

Important Tax Dates and Deadlines in 2025

Popular tax deadline questions answered. When are taxes due? When are business taxes due? All the dates you need to make sure your taxes are filed on time in 2025.

A Guide for Tax Exempt Organizations

Find all that you need to know about Form 990 for 501(c)(3) organizations — what it is, important deadlines, how to file online & more.

A solution for every tax situation

Not sure where to start? Take our 2-question quiz and find the right tax prep option for you in 30 seconds.