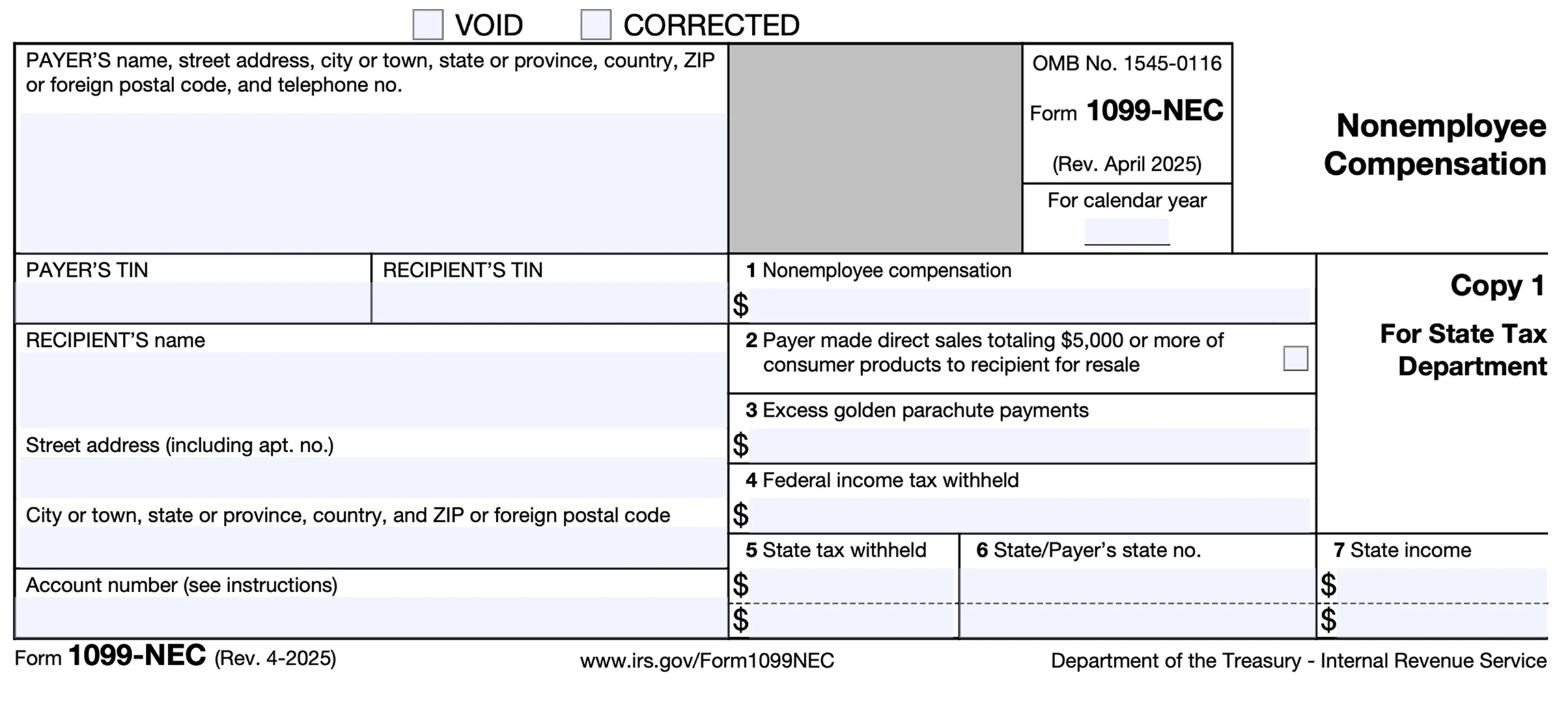

Form 1099-NEC

Form 1099-NEC, Nonemployee Compensation, is a tax form specifically designed to report payments made to those who aren’t considered employees.

Understand Your Form 1099-NEC

Box 1: Nonemployee compensation

Reports total payments made to you.

Box 4: Federal income tax withheld

This box is for federal income tax withholding. If the payer collected any backup withholding from you, you’ll find that amount here.

Box 5–7: State information

If any state income tax was withheld, you’ll see that amount in box 5. Box 6 is for the state identification number, and box 7 records the amount of state income.

Related Information

Understanding the 1099-NEC Form: A Complete Guide

Learn more about Form 1099-NEC (Nonemployee Compensation) and get quick answers to common FAQs about who receives it, what it reports, and how to file it correctly.

Comprehensive Guide to Filing Taxes as a Gig Worker

Learn how to file taxes as a gig worker, how to determine your tax status, and the valuable tax deductions available to gig workers.

Form 1099-NEC vs. Form 1099-K: What’s the Difference?

Learn the difference between Form 1099-NEC and Form 1099-K. Find out why both forms are important to self-employed business owners.

A solution for every tax situation

Whether you’re filing for the first time, claiming education credits, or managing retirement income, TaxAct makes it easy to file with accuracy.

Guided support for W-2 earners, retirees, and joint filers

Handles education credits and deductions with ease

Built-in checks help catch common mistakes before you file