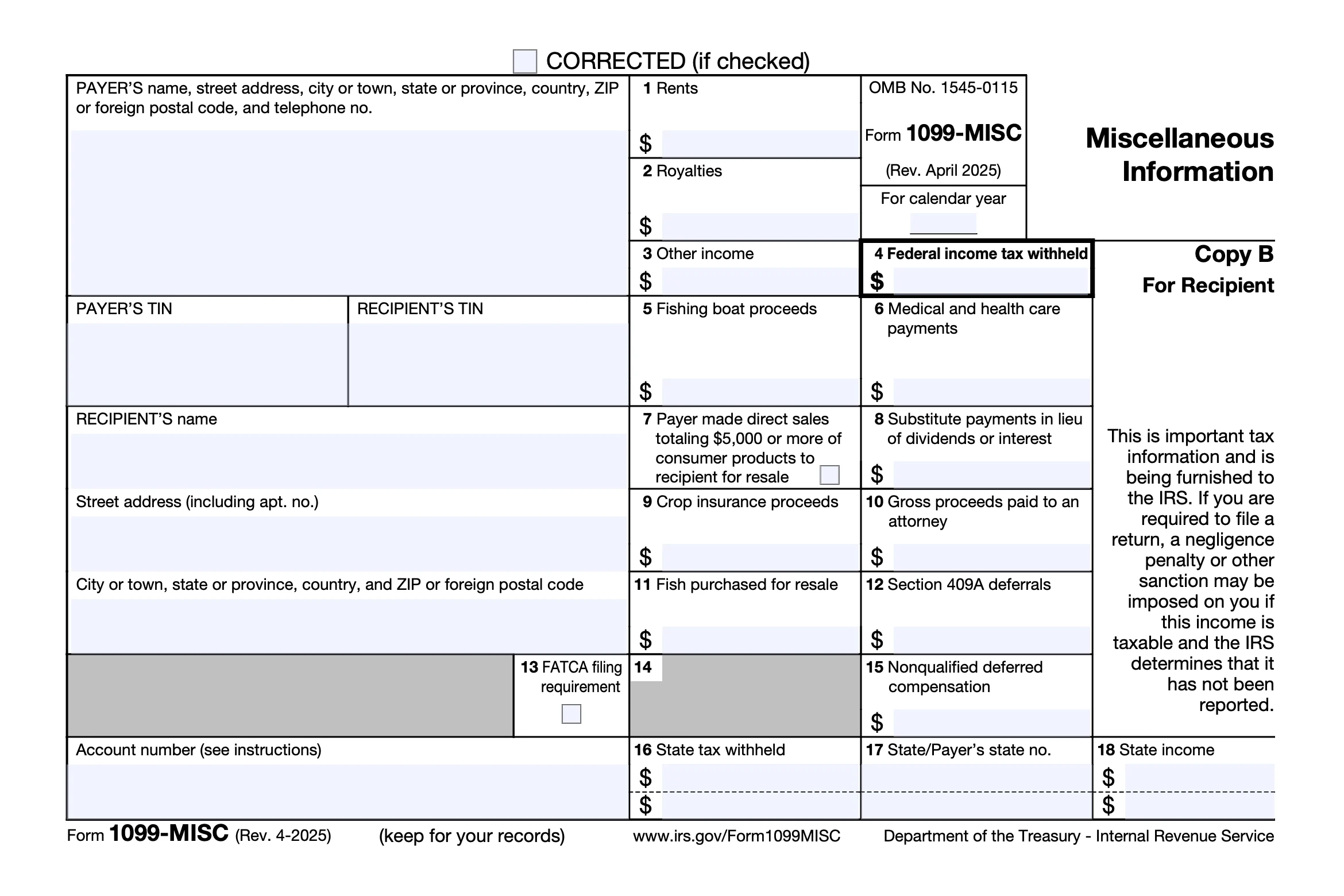

Form 1099-MISC

Reports payments you received for certain items like rent, royalties, prizes/awards, or lottery winnings.

Payers file Form 1099-MISC with the IRS and send you a copy, so it’s important you report these amounts when you file your tax return.

Understand Your Form 1099-MISC

Box 1: Rents

Shows rent payments you received.

Box 2 & 8: Royalties & Substitute payments

These boxes report at least $10 in royalties (Box 2) or broker payments in lieu of dividends or tax-exempt interest (Box 8).

Box 3: Other Income

This shows $600 or more of other income paid to you that doesn’t fit in any of the other boxes on your 1099-MISC.

Box 4: Federal income tax withheld

Federal tax that was withheld from your payments (usually backup withholding) and sent to the IRS.

Box 5: Fishing boat proceeds

Shows your share of proceeds (and/or the value of in-kind distributions) from a fishing boat’s catch, plus certain trip-based cash payments.

Box 6: Medical and health care payments

Medical/healthcare payments made to you in the course of the payer’s business (typically paid to providers or suppliers).

Box 7: Direct sales $5,000+

If checked, it means the payer sold you $5,000 or more of consumer products for resale (this is a checkbox, not a dollar amount).

Box 9: Crop insurance proceeds

Shows crop insurance proceeds paid to you.

Box 10: Gross proceeds paid to an attorney

Gross proceeds paid to you (as an attorney) in connection with legal services; this can be reported even if the payment wasn’t for your own services.

Box 11: Fish purchased for resale

Cash payments you received for fish you caught that were purchased for resale.

Box 12: Section 409A deferrals

May show the total amount deferred for you during the year under nonqualified deferred compensation arrangements, including certain earnings.

Box 15: Non-qualified deferred compensation

Shows amounts included in your income because a non-qualified deferred compensation arrangement didn’t meet Section 409A rules.

Related Information

Form 1099-MISC: What It Is and How to Use It

Received a 1099-MISC for rent, royalties, prizes, or awards? Our blog explains how this income is reported and what to do when you file.

Tax Implications of Owning Rental Property

New landlord or first rental property? This guide explains what rental income is taxable, what expenses may be deductible, and what to watch for at tax time.

How to enter 1099-MISC

Need help filing 1099-MISC in TaxAct? Use this step-by-step guide to add or edit a 1099-MISC in your return (Online dashboards, Classic, or Desktop).

A solution for every tax situation

Whether you’re filing for the first time, claiming education credits, or managing retirement income, TaxAct makes it easy to file with accuracy.

Guided support for W-2 earners, retirees, and joint filers

Handles education credits and deductions with ease

Built-in checks help catch common mistakes before you file