Form 1099-K

Form 1099-K is an informational return that records transactions from credit or debit cards and third-party payment networks.

You might receive Form 1099-K for different reasons, and how you report it depends on where the income came from.

Understand Your Form 1099-K

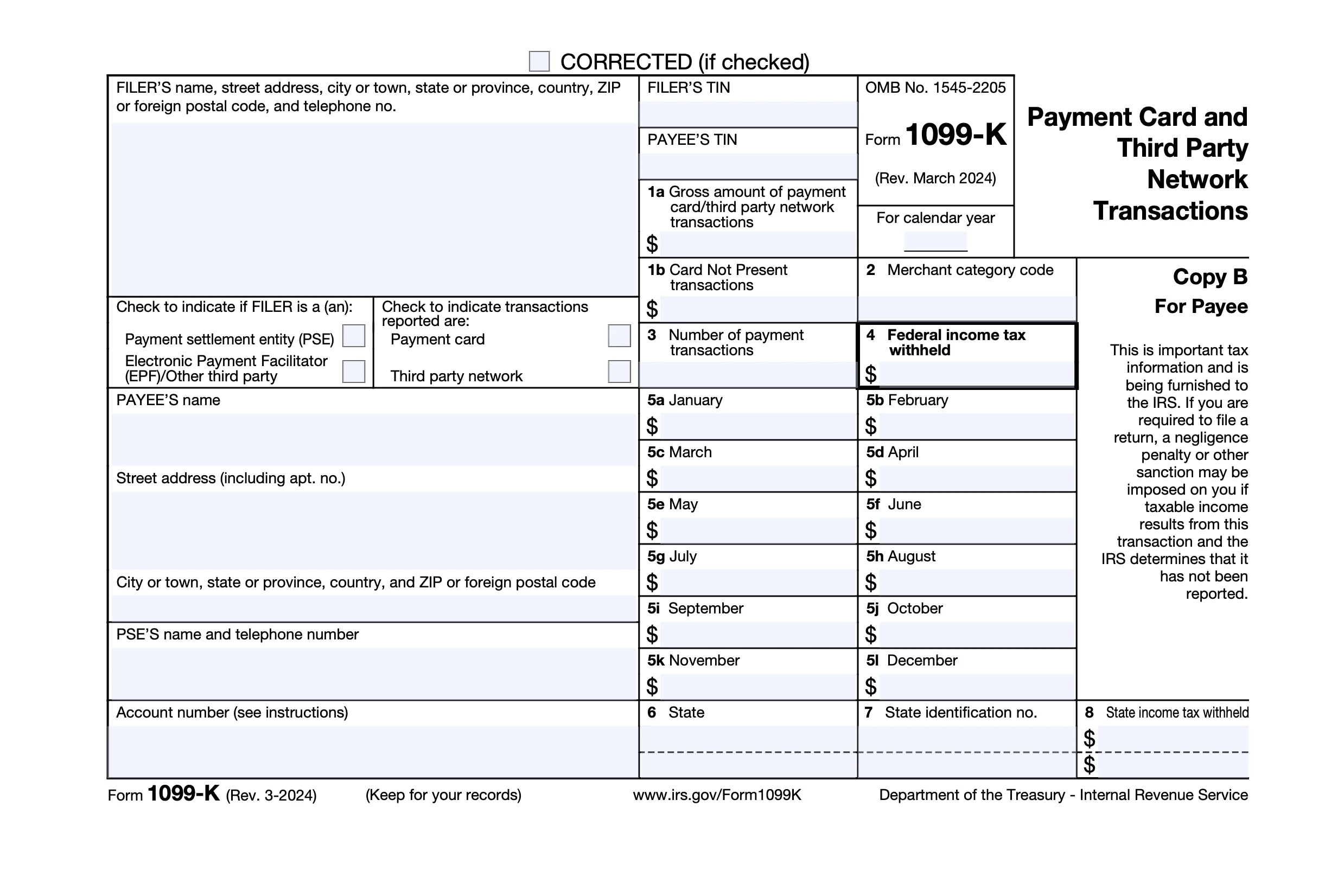

Box 1a: Gross amount of payment card/third-party network transactions

Shows the total payments processed for you during the year. This figure is your gross income, meaning it doesn’t consider any refunds, fees, shipping, etc.

Box 1b: Card not present transactions

This box details the total amount of payments where the card was not physically present (think online purchases).

Box 3: Number of payment transactions

The total number of payment transactions processed for you throughout the year. This is useful for your records and might be of interest if you compare year-over-year data or calculate average transaction amounts.

Box 4: Federal income tax withheld

If any federal income tax was withheld from your payments, it will be reported here. This is unusual for most people, but if it applies to you, make sure to include this amount when you’re filing your taxes — it’ll go toward covering your tax liability.

Box 8: Tax-exempt interest

These boxes show monthly gross payment amounts. They’re helpful for tracking income trends during the year or matching your records to the 1099-K. It’s a snapshot of monthly earnings that can help explain why one month was better (or worse) than another.

Related Information

Form 1099-K: What It Is, Real-Life Examples, and How to Use It

You might receive Form 1099-K for different reasons, and how you report it depends on where the income came from.

The New 1099-K Reporting Thresholds: What You Need to Know

Understand the impact of new 1099-K reporting thresholds for taxpayers. Get answers to your Form 1099-K FAQs & address common misconceptions.

Form 1099-NEC vs. Form 1099-K: What’s the Difference?

Learn the difference between Form 1099-NEC and Form 1099-K. Find out why both forms are important to self-employed business owners.

A solution for every tax situation

Whether you’re filing for the first time, claiming education credits, or managing retirement income, TaxAct makes it easy to file with accuracy.

Guided support for W-2 earners, retirees, and joint filers

Handles education credits and deductions with ease

Built-in checks help catch common mistakes before you file