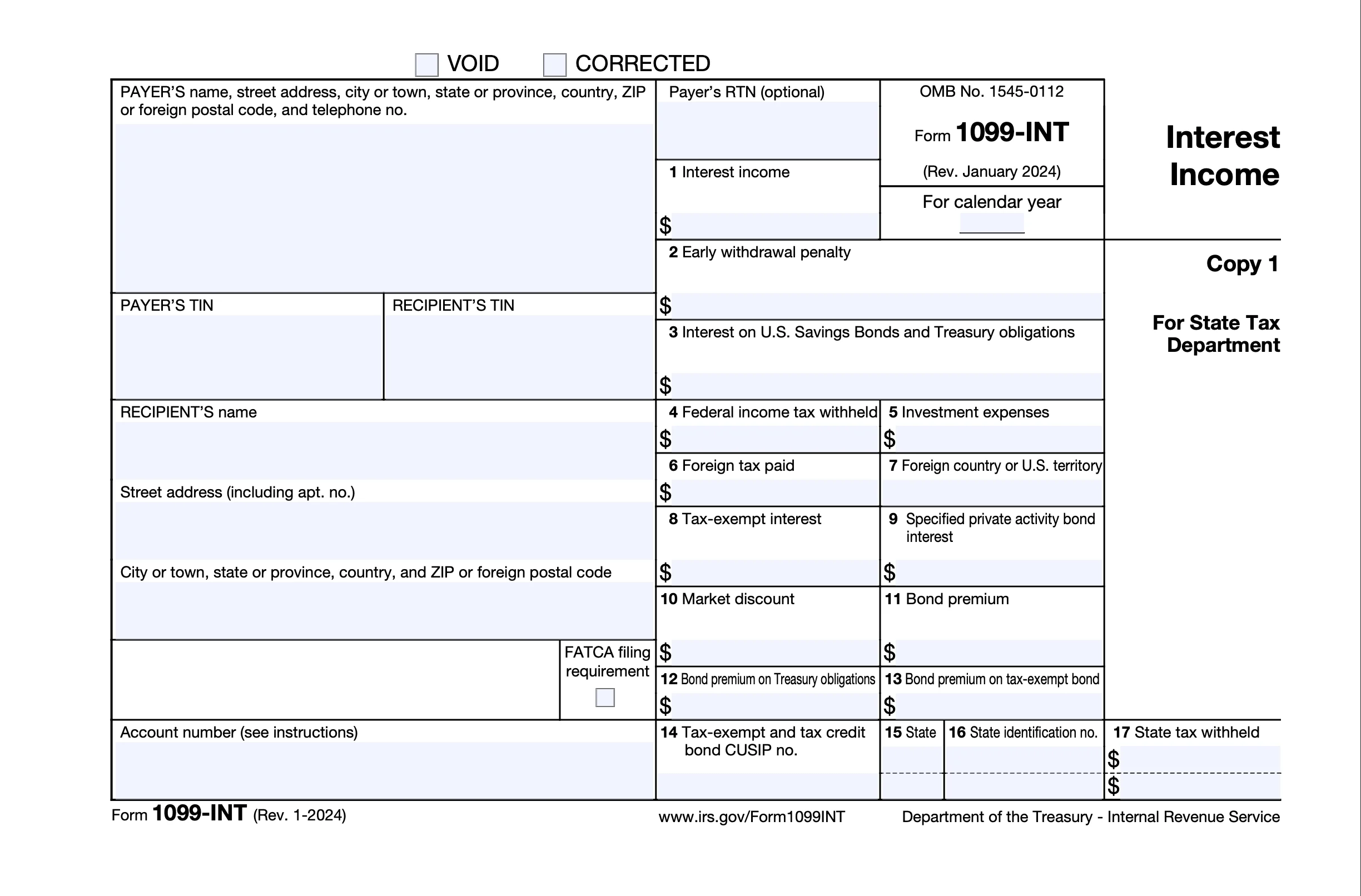

Form 1099-INT

Got Form 1099-INT? You’ll receive this form if you earn at least $10 in interest during the tax year.

Payers send copies of Form 1099-INT to you and the Internal Revenue Service (IRS), so it’s important you report your interest income on your tax return.

Understand Your Form 1099-INT

Box 1: Interest income

Taxable interest over $10 you must report, including $600+ earned through a trade or business.

Box 2: Early withdrawal penalties

Reports any principal or interest forfeited due to early withdrawal of funds, if applicable. This amount can be deducted from your gross income.

Box 3: Interest on U.S. savings bonds and treasury obligations

The amount of interest earned from U.S. Savings Bonds, as well as Treasury bills, notes, and bonds issued by the federal government. This interest isn’t included in the amount in box 1.

Box 4: Federal income tax withheld

shows any federal income tax that was withheld from your interest income. This can happen if you don’t provide the payer with your TIN.

Box 5: Investment expenses

Box 5 shows certain fees or expenses related to the investment.

Box 6: Foreign tax paid

Shows any foreign tax you paid on your interest income, which may help you claim a foreign tax credit or deduction on your tax return.

Related Information

Form 1099-INT: What It Is and How to Use It

Still have questions about your 1099-INT? Check out our blog for detailed explanations, FAQs, and helpful tips to file with confidence.

How to enter 1099-INT

Need help in TaxAct? Use this step-by-step guide to add or edit a 1099-INT in your return (Online dashboards, Classic, or Desktop).

7 Creative Ways to Make Extra Money With Passive Income

Looking to earn passive income? Here are 7 ways to earn passive income, including how to get started, maintaining income, and tax concerns.

A solution for every tax situation

Whether you’re filing for the first time, claiming education credits, or managing retirement income, TaxAct makes it easy to file with accuracy.

Guided support for W-2 earners, retirees, and joint filers

Handles education credits and deductions with ease

Built-in checks help catch common mistakes before you file