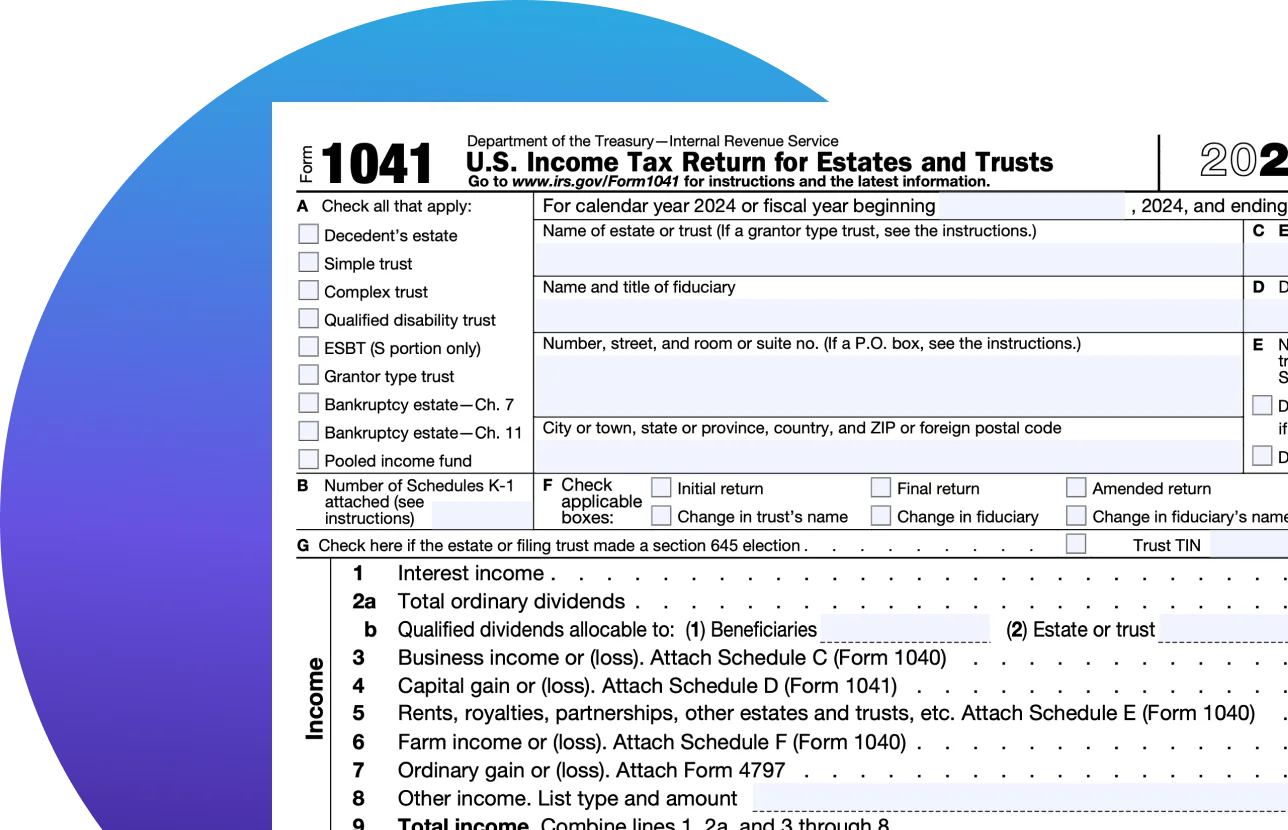

What Is Form 1041?

IRS Form 1041 is the U.S. Income Tax Return for Estates and Trusts. It is used to report income earned by a decedent’s estate or trust after the estate owner’s date of death but before assets are distributed to beneficiaries.

Related Information

Your Guide to Filing Form 1041

Learn how to file IRS Form 1041, who needs to file it, and what each schedule is for. This comprehensive guide simplifies estate and trust tax filing.

Taxes on Investments: What Investors Need to Know

Learn how investments are taxed, including capital gains, dividends, and tax-efficient strategies to minimize your tax burden.

A Guide for Filing Form 1041 Estates & Trusts

Explore helpful articles and step-by-step guides on filing Form 1041, estate and trust taxes, and other complex filing topics on the TaxAct Blog.

A solution for every tax situation

Not sure where to start? Take our 2-question quiz and find the right tax prep option for you in 30 seconds.