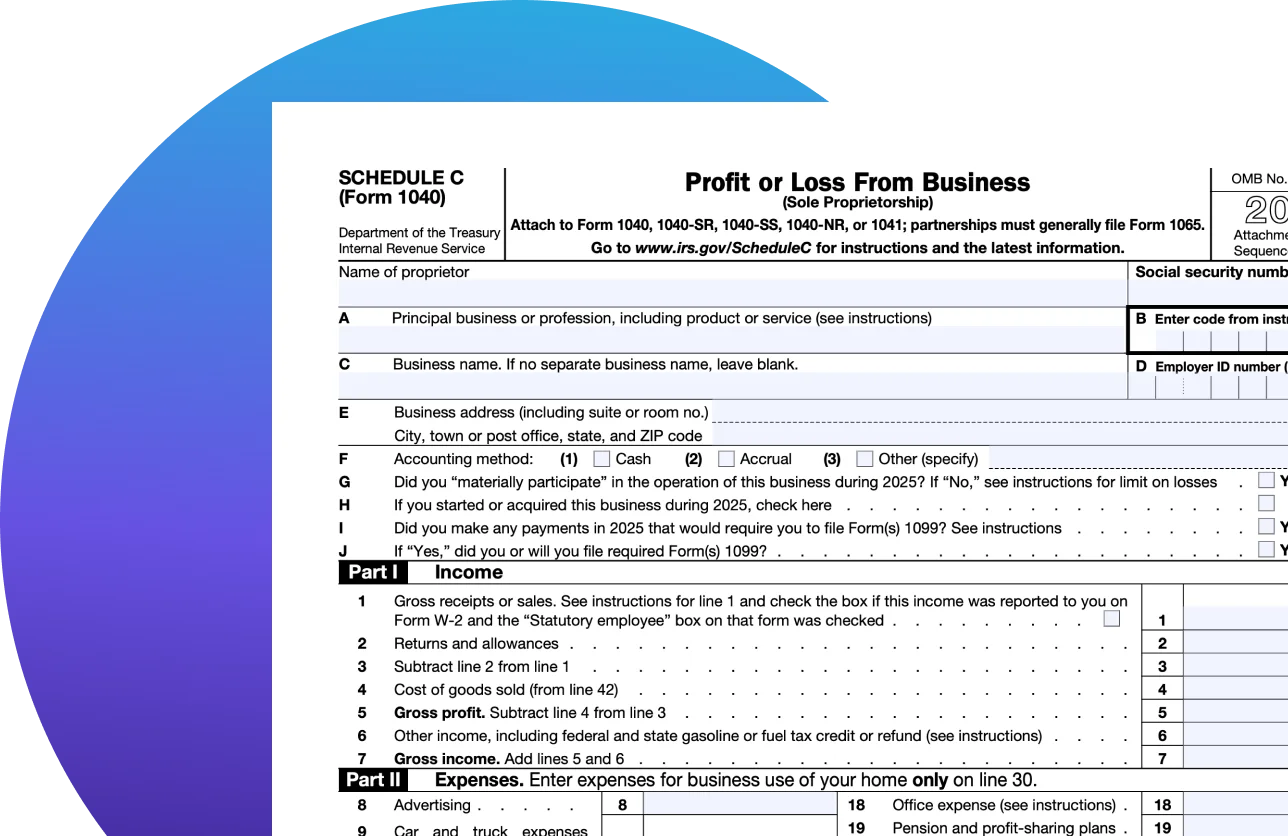

What Is Schedule C?

IRS Schedule C reports self-employment income and expenses from a sole proprietorship or other qualifying business activity. In general, you’re required to file Schedule C if you earned $400 or more in net profit from self-employment during the tax year.

Understand Schedule C

Part I: Income

In Part I, total up your business income:

Start with gross receipts (total sales), subtract returns and allowances. If you sell products, subtract cost of goods sold (Part III) to find gross profit. Add any other business income not reported elsewhere in Part I.

Part II: Expenses

This is where your deductions live. The IRS calls these your ordinary and necessary business expenses.

Beginning and ending inventory, purchases (minus personal use), labor costs (not payments to yourself), and materials, supplies, and other direct production costs. COGS lowers taxable profit, so keep good records.

Part III: Costs of Goods Sold

If you sell physical products, Part III calculates the cost of goods sold (COGS). This commonly includes:

Beginning and ending inventory, purchases (minus personal use), labor costs (not payments to yourself), and materials, supplies, and other direct production costs. COGS lowers taxable profit, so keep good records.

Part IV: Information on Your Vehicle

Part IV supports your vehicle deduction, if applicable, and tracks:

List when you began using the vehicle for business, total miles driven vs. business miles (commuting doesn’t count), and whether you have written evidence that meets IRS record keeping requirements.

Part V: Other expenses

Part V lets you list other expenses that don’t fit neatly elsewhere. Be specific and accurate to avoid setting off IRS red flags. Examples of expenses listed here might include::

Deductions for amortization, bad debts, business startup costs, sound recording expenses, and technology or software tools used in your business.

Related Information

Schedule C: How to Report Business Income & Expenses

Learn what IRS Schedule C is, who needs to file, what income & expenses to report, common deductions like home office & mileage, & how to file Schedule C with TaxAct.

Sole Proprietorship vs. LLC: Which Business Structure is Right?

Compare sole proprietorships vs. LLCs. Learn about taxation, liability & more to make an informed choice for your business structure.

A solution for every tax situation

Not sure where to start? Take our 2-question quiz and find the right tax prep option for you in 30 seconds.