Integrated eSignatures.

Integrated eSignature makes it easier for you and your clients to get the signature you need to e-file. Plus, it’s backed by DocuSign®.1

Order eSignatures

There are many benefits to eSignatures.

Flexibility to pay as you go with - $5 price offered at a discounted rate of - $2.99 per envelope (up to 2 KBAs).²

Collect eSignatures on certain tax documents, such as e-file authorization forms (Federal Form 8879 and state equivalents), applications for Bank Products, and other documents related to tax preparation services (excluding Federal Forms 990 and 1041).³

Stay Compliant - Knowledge Based Authentication (KBA) – IRS requires that documents sent online have this for security purposes.

How easily eSignature works.

Request signature

Send any document to client.

Customer signs

Its secure and only takes a few clicks.

Ready to e-file

Once forms are signed, they are ready for the next step.

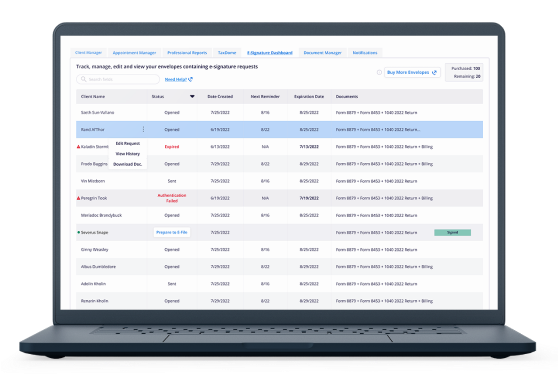

Easily track the progress of eSignature requests in the dashboard.

Manage signatures digitally and track client response with real-time status updates on the virtual signature dashboard in your tax software.

Order eSignatures

Buy TY25 eSignatures now to receive volume pricing and save.

Or you can pay as you go in the product.

Pay as You Go

per envelope

Bundle of 25

$2.75 per envelope

Bundle of 100

$2.50 per envelope

Bundle of 250

$2.25 per envelope

Need more than 250 eSignatures? Contact our sales team: (866) 498-7184.

eSignature Frequently Asked Questions

DISCLOSURES:

¹All trademarks not owned by TaxAct, Inc. that appear on this website are the property of their respective owners, who are not affiliated with, connected to, or sponsored by or of TaxAct, Inc. DocuSign is a registered trademark of DocuSign, Inc.

²Purchased envelopes and KBAs for TY24 will activate on or after January 1, 2026, and will expire on December 31, 2026. Purchased but unused envelopes and KBAs have no monetary value, before or after their expiration.

³In product eSignatures are available on tax return documents, such as e-file authorization forms (Federal Form 8879 and state equivalents), applications for bank products, and other documents related to tax preparation services, but specifically excluding Federal Forms 990 and 1041.