Simple, accurate online filing for Sole Proprietor taxes.

Form 1040, Schedule C and F

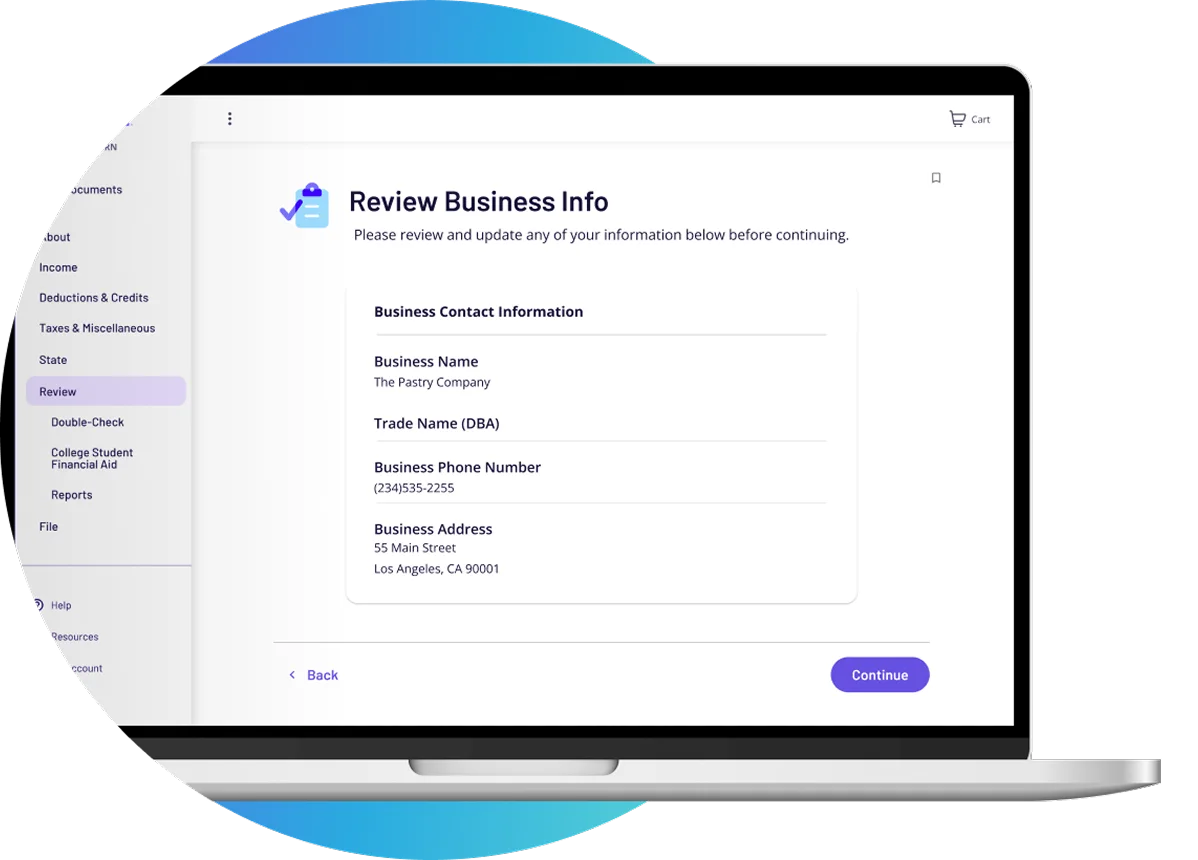

Everything you need to file your Schedule C, self-employment taxes, and claim business deductions — all in one place.

Simple, accurate filing designed for sole proprietors.

Import data from PDF files of 1040 returns prepared by TurboTax® and H&R Block®.

Clear guidance and error checks for your peace of mind.

Better than my former accounting firm

I spent thousands for years and once I switched to TaxAct I discovered deductions for my business that I qualified for and was never informed of. I have been referring TaxAct to my friends and business associates ever since.

Verified TaxAct Customer

Mar 25, 2025

Easy process

It makes it easy and it’s affordable and secure. I would definitely use it again!

Verified TaxAct Customer

Sep 9, 2025

Trusted filing with guaranteed accuracy.

Join over 650,000 businesses who have trusted us with their tax returns since 2003.

Start FilingMaximize your business deductions.

We help you uncover the business deductions and tax credits available to sole proprietors— including vehicle expenses, home office deductions, supplies, and more —with clear, step-by-step guidance so you can file confidently and keep more of what you earn.

Auto-import for key tax forms.

Whether you receive 1099-NECs, 1099-Ks, or mixed freelance income, quickly pull it all in to build an accurate Schedule C.

Extended access to your return.

Keep digital access to your return and worksheets for future planning, loan applications, or year-over-year comparison.

Import from TurboTax® or H&R Block®.

Easily bring over your prior-year information from supported products to save time and reduce manual entry.

Security is a top priority.

Your data is safe with us. We take privacy and compliance seriously so you can have peace of mind.

Guidance for self-employment tax.

Understand how self-employment tax works, estimate what you owe, and ensure you capture eligible credits like the qualified business income (QBI) deduction.

100% Accuracy Guarantee*

Rest assured, TaxAct guarantees the calculations on your return are 100% correct.

Satisfaction Guarantee*

With any TaxAct Online product your satisfaction is 100% guaranteed.

7-year return access

Easily access and print copies of your prior returns for seven years after the filling date.

100% Accuracy Guarantee*

Rest assured, TaxAct guarantees the calculations on your return are 100% correct.

Satisfaction Guarantee*

With any TaxAct Online product your satisfaction is 100% guaranteed.

7-year return access

Easily access and print copies of your prior returns for seven years after the filling date.

Prefer Offline? Download the Software.

Edit directly in forms and work offline with our downloadable software for PC.

View Desktop FilingAll-Inclusive Bundle

Our money-saving bundle includes our top products to help you file with peace of mind.

File your federal return (Form 1040) and one state return with access to all online forms and schedules.

The All-Inclusive Bundle combines our top tools — like Refund Transfer, Audit Defense, E-File Concierge — to help you file confidently and save money. Additional states can be added for a fee.

Select list of Federal and State tax forms supported

Below are the Partnership forms included with this product. Release status is updated as forms become available. For the most up-to-date status of any form, visit our main forms page.

Form | Description |

|---|---|

| Form 1040 | US Individual Income Tax Return |

| Form 1040 NR Schedule A | Itemized Deductions |

| Form 1040 NR Schedule NEC | Tax on Income Not Effectively Connected With a U.S. Trade or Business |

| Form 1040 NR Schedule OI | Other Information |

| Form 1040 NR Schedule P | Foreign Partners Interests in Certain Partnerships Transferred During Tax Year |

| Form 1040 SR | US Tax Return for Seniors |

| Form 1040 SS | US Self Employment Tax Return for Residents of Puerto Rico |

| Form 1040ES | Estimated Tax Payment Voucher |

| Form 1040NR | US Nonresident Alien Income Tax Return |

| Form 1040V | Individual Payment Voucher |

File your Sole Proprietor taxes with expert help.

Get unlimited access to experts while you DIY, or hand everything off for full-service tax prep — it’s your choice.

Do it yourself

File with confidence using our simple, step-by-step guidance and built-in tools.

Your data stays secure with trusted safeguards, and our 100% Accuracy Guarantee* has you covered. And whenever questions come up, our support team is here to provide fast, reliable help so you can file with confidence.

Start FilingFrequently Asked Questions

You can file for free yourself with TaxAct's Free Edition if you meet the qualifications below, including filing using IRS Form 1040 only without having to attach any forms or schedules. Only certain taxpayers are eligible.

Situations covered (assuming no added tax complexity):

W-2 income, Unemployment income, Retirement income

Earned Income Tax Credit, Child Tax Credit

Dependents

Current Students

Student loan interest

Situations not covered:

Investment income: Stock, interest, dividends, crypto, or capital gains/losses

Sale of home, real estate taxes, mortgage interest, or rental property income

Royalty, trusts, and foreign accounts

Business and farm income

Itemized deductions

Adoption credits and child and dependent care

Health Savings Account (HSA)

Freelance, contractor, side hustle, or self-employed income and expenses