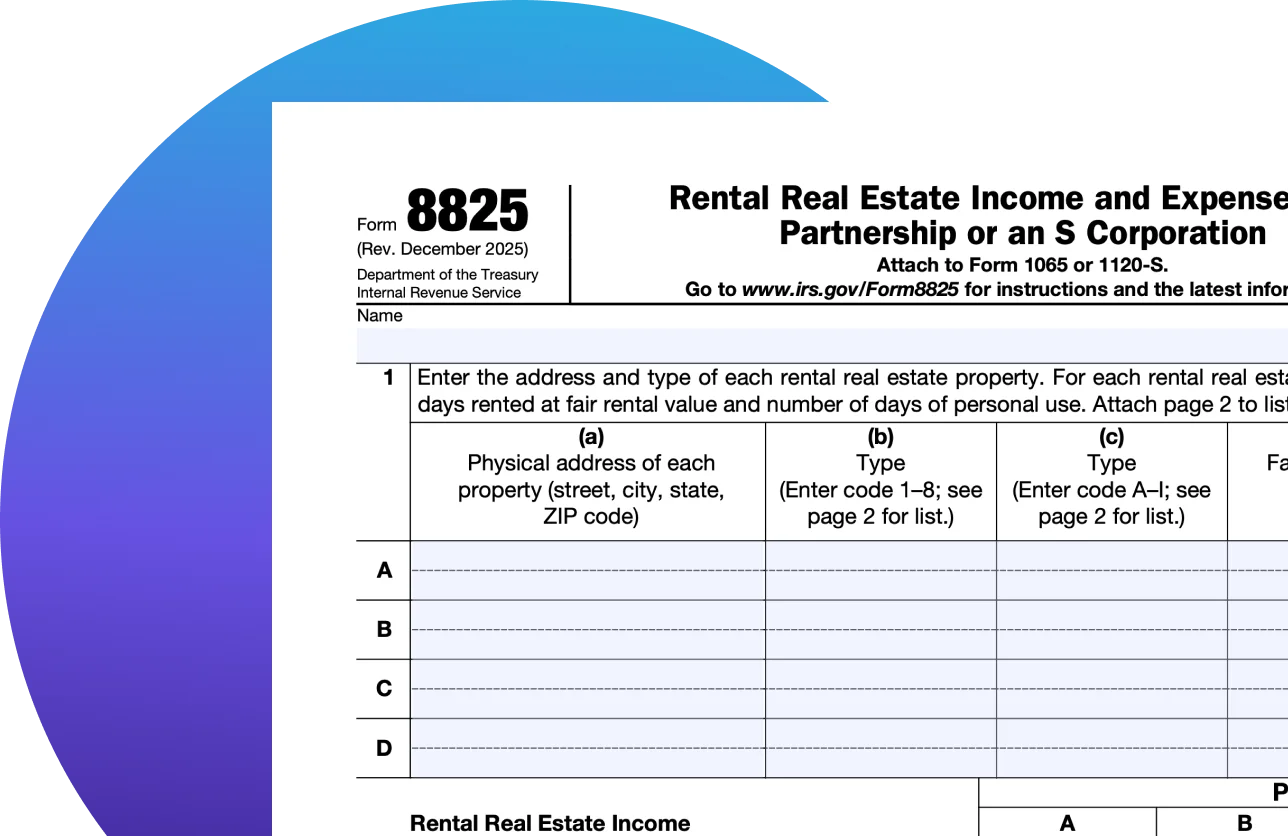

What Is Form 8825?

Form 8825 is an IRS form used to report income and deductible expenses from rental real estate owned by pass-through entities. This form summarizes rental activity for each property owned, including rental income, operating expenses, and depreciation.

Understand IRS Form 8825

Section I: Your rental properties Rows (A-D) Columns (a-e)

To prepare for this section, you’ll want to build a property list and track fair rental days and personal-use days. You’ll need to provide the following information for each of your properties:

• (a) Physical Address of each property (street, city, state, ZIP code)

• (b) Type of property and code: 1 – Single-family residence, 2 – Multi-family residence, 3 – Vacation or short-term rental, 4 – Commercial, 5 – Land, 6 – Royalties, 7 – Self-rental, 8 – Other

• (c) Other codes: A Nontaxable contribution; B Other exchange; C Taxable acquisition; D New construction/renovation or basic addition/subtraction; E For future use; F Nontaxable distribution; G Taxable disposition; H Abandonment; I Other/supplement

• (d) Number of fair rental days

• (e) Number of personal-use days

Section II: Rental real estate income (lines 2a-c)

Beginning in this section, you’ll enter amounts for each property using the same property columns you completed in Section I.

• Enter your gross rents (2a)

• Enter other income related to rental real estate activity (2b)

• Add lines 2a and 2b to enter the total rental real estate income for each property (2c)

Section III: Rental real estate expenses (lines 3-18)

Here, we’ll focus on numbers 3 through 18. These lines are where you’ll report your categorized deductible expenses. It’s essential to keep receipts and statements so you can accurately record this information.

• Enter the amount for each expense type listed (3-17)

• Add lines 3-17 for the total rental real estate expenses for each property (18)

Section IV: Property net income or loss (line 19)

This section focuses specifically on line 19. You’ll need to provide the net income or loss for each property. To get this information, you must subtract your total rental real estate expenses (18) from your total rental real estate income (2c).

Section V: Totals (lines 20a-22b)

Now that you’ve filled out the information above, you can include the summary totals. Enter the following information:

• Total rental real estate income (20a)

• Total rental real estate expenses (20b)

• Net gain or loss from sale of property (21), which would be included in Part II, line 17 of Form 4797

• Net income or loss from rental real estate activities from partnerships, estates, and trusts, in which this partnership or S corporation is a partner or beneficiary on Schedule K-1 (22a)

• The names and employer identification numbers (EIN) of the partnerships, estates, or trusts from line 22a (22b)

Section VI: Report on main return (23)

Finally, you’ll combine the totals from lines 20a through 22a and enter the result on line 23 of Form 8825. The same amount is then reported on Schedule K, line 2 of Form 1065 or 1120-S.

Related Information

Form 8825: Rental Real Estate for Partnerships and S Corps

A guide to Form 8825 for partnerships and S corps: what to report by property, how depreciation fits in, and how results flow to K-1s.

Tax Implications of Owning Rental Property

Knowing tax implications of owning a rental property can help you create a plan to lower your tax bill. Learn about the benefits of owning a rental real estate.

16 Small Business Tax Deductions

Discover common deductions like home office, vehicle expenses, and startup costs to help reduce taxable income and maximize savings for your business.

A solution for every tax situation

Not sure where to start? Take our 2-question quiz and find the right tax prep option for you in 30 seconds.