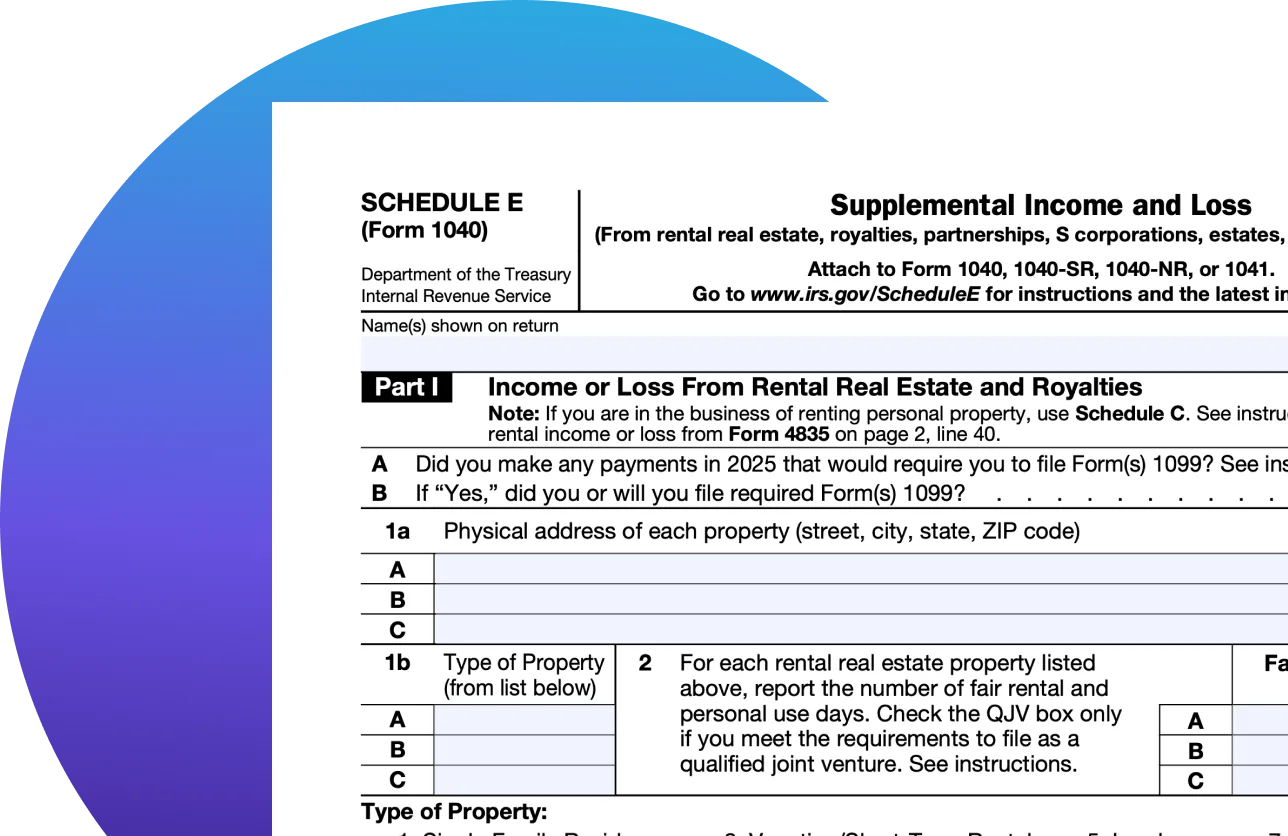

What Is Schedule E?

Schedule E (Form 1040), Supplemental Income and Loss, is where you report income or losses from rental real estate and royalties (Part I), as well as certain income or losses that pass through to you on Schedule K-1 (Parts II and III).

Understand Schedule E

Part I: Rental real estate and royalties.

Lists all properties and reports rents received for each, then subtracts deductible expenses like repairs, insurance, and depreciation.

Part II: Partnerships and S corporations.

Reports pass-through income or loss from Schedule K-1 issued by partnerships or S corps.

Part III: Estates and trusts.

Reports income or loss if you’re a beneficiary of an estate or trust, using information from Schedule K-1.

Part IV: REMICs.

Reports income from REMICs, often provided on Schedule Q.

Part V: Summary.

Totals income and losses from all Schedule E and carries the net amount to your Form 1040.

Related Information

Schedule E: How to Report Supplemental Income and Loss

Learn what Schedule E covers, common rental deductions, and how passive loss rules work, plus tips to file with confidence.

Tax Implications of Owning Rental Property

Knowing tax implications of owning a rental property can help you create a plan to lower your tax bill. Learn about the benefits of owning a rental real estate.

16 Small Business Tax Deductions

Discover common deductions like home office, vehicle expenses, and startup costs to help reduce taxable income and maximize savings for your business.

A Guide for Rental Property Owners

Find all that you need to know about Schedule E — what it is, how to file it.

A solution for every tax situation

Not sure where to start? Take our 2-question quiz and find the right tax prep option for you in 30 seconds.